If you have more money to put down on a home, should you?

In our experience, many buyers don’t quite understand how much money they must put down for a loan to qualify for a mortgage. Many assume they have to put down 20%, but that’s not true. According to Fannie Mae, more than one-third of all Americans overestimate how much money they need to put down.

How much money you need to put down depends on a few factors, including your credit score, the price of the home, and which loan program you use. Many programs require as little as 5%, 3%, or even 0% down. If you prefer to put down more than 20%, you’re more than welcome to. If you put down less than 20%, you will have to pay private mortgage insurance (PMI), which is added to your monthly payment.

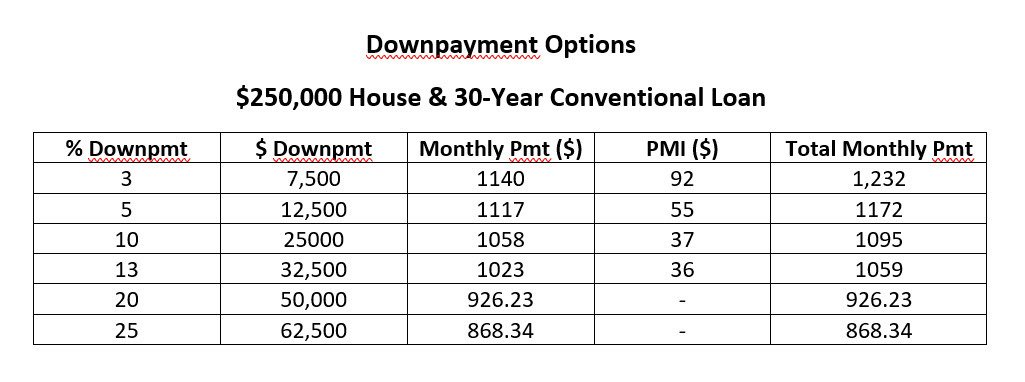

At 1:24 in the video above, I’ve provided a chart that lists your down payment options when using a 20-year conventional loan for a $250,000 house. For example, if you put down 3% in this situation, your down payment would be $7,500 and your total monthly mortgage payment would be $1,232. If you put down 5%, your total monthly mortgage payment would be $1,172. At 10%, your total monthly mortgage payment decreases to $1,095. At 20%, it shrinks to $926.

As you can see, the monthly difference between 3% and 20% is about $300. However, at 20%, you’d have to put down $50,000. That’s why it’s important to know how much you’d actually have to take out of your savings when deciding on what to put down. Also, keep in mind that there are three other items added into your monthly payment: your monthly taxes, insurance, and homeowners dues.

So, in answering the question of how much money you should put down, you have to ask yourself another question: How risk-averse are you? Some buyers just want to have the lowest payment possible so they can pay off the mortgage as fast as possible. Others are okay with their payment being a little higher and using what’s left of their savings to diversify their investments. Investing in real estate and buying your own home is a fantastic investment, but it’s a non-liquid asset.

In a previous video I explained how buyers can avoid PMI if you put down less than 20%.

When buying a home, getting a loan is an important, complicated part of the process, so be sure to have your Realtor refer you to their most trusted lender so you can educate yourself. This is what we do with our clients daily, so if you give us a call. We’d be glad to give you the name of one of our trusted lenders.

As always, if you have any more questions about this or any other real estate topic, don’t hesitate to reach out to me. I’d love to help you.