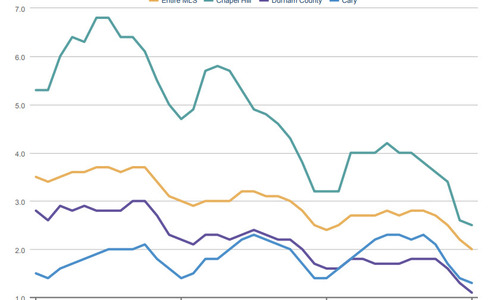

Triangle Area Market Update: Are We Still in a Seller’s Market?

Chatham County’s market is shaping up to be a good place f…

Chatham County’s market is shaping up to be a good place f…

Here’s what you should know about our real e…

On Sunday, March 15, 2020, the federal government cut the fe…

The latest are numbers in for our real estate market and I�…

Real Estate Market Update: Sales prices in Chapel Hill, Du…

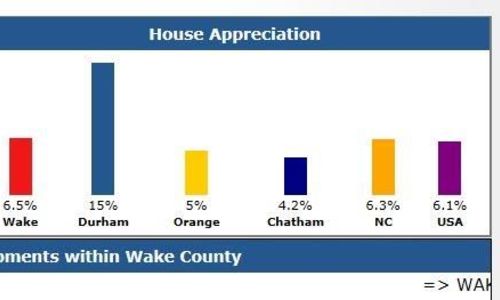

Let’s go over what the current Triangle Area…

What’s the forecast for our 2020 Triangle area market? To …

When you are saying that the Cary North Carolina market has …

Real Estate Market Update -- The National Association of Rea…