What Do Realtors Have To Tell You? What Are Material Facts?

Understanding the things that a Realt…

Understanding the things that a Realt…

Let’s go over what the current Triangle Area…

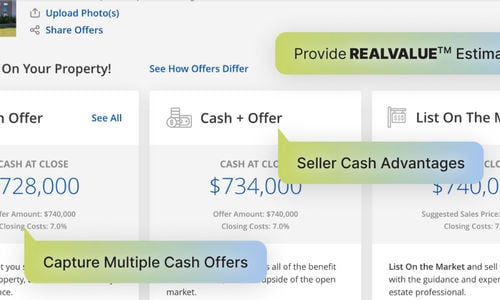

Introducing two new options that are available to our s…

Given the state of the market, should you jump into the fray…

I am an advocate for sellers get…

https://youtu.be/Lf64jSKA9RQ?si=maeCyDvMD5XXbSGL To sum t…

Are you feeling overwhelmed by the size of your current home…

If you’re thinking about selling your home anytime soon, y…

If your parents are reaching old age and need to sell their …

Photo via Pexels Planning what to do with your assets is a …