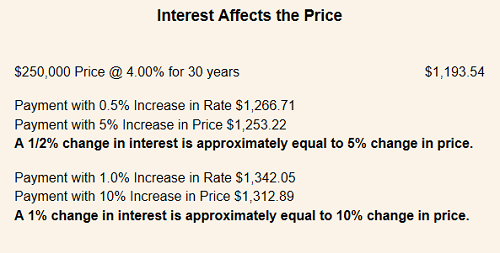

Sinc e the election, interest rates are rising and they will have a direct effect on the cost of housing. There is a rule of thumb that a ½% change in an interest rate is approximately equal to a 5% change in price.

e the election, interest rates are rising and they will have a direct effect on the cost of housing. There is a rule of thumb that a ½% change in an interest rate is approximately equal to a 5% change in price.

As the interest rates go up, it will cost you more to live in the very same home, or to keep the payment the same, you’ll have to buy a lower priced home.

Before rates rise too much, this may be the best time to buy a home whether you’re going to use it for your principal residence or a rental property. Low interest rates and lower prices make housing more affordable.

The Impact of Rising Interest Rates on Home Ownership

Many home buyers understand that rising home prices can affect their ability to buy. Many people, however, don’t realize that rising interest rates have an even greater impact. For the last few years, interest rates have been at historic lows.

According to Erik Martin, a reporter with The Mortgage Reports, “Housing agency Freddie Mac recently predicted that mortgage rates will rise to 4.0% in 2017. That’s more than 50 basis points (0.50%) higher than the current mortgage rate average.”

As illustrated above, as interest rates rise, your buying power decreases. In this case, to keep your mortgage payment the same, a buyer would need to either put down more money, bring in a co-borrower for help, or look at a different form of financing than a conventional loan, such as an adjustable rate mortgage or an 80/10/10 piggy back loan.

If interest rates rise a full 1%, the typical buyer would need to spend $35,000 less on their home purchase. This is significant! In many places, home values are rising too so this amounts to a double whammy for home buyers.

Our recommendation at Real Estate Experts is to watch mortgage rates very closely. If you are looking to buy, let one of our top realtors help you find the home of your dreams.